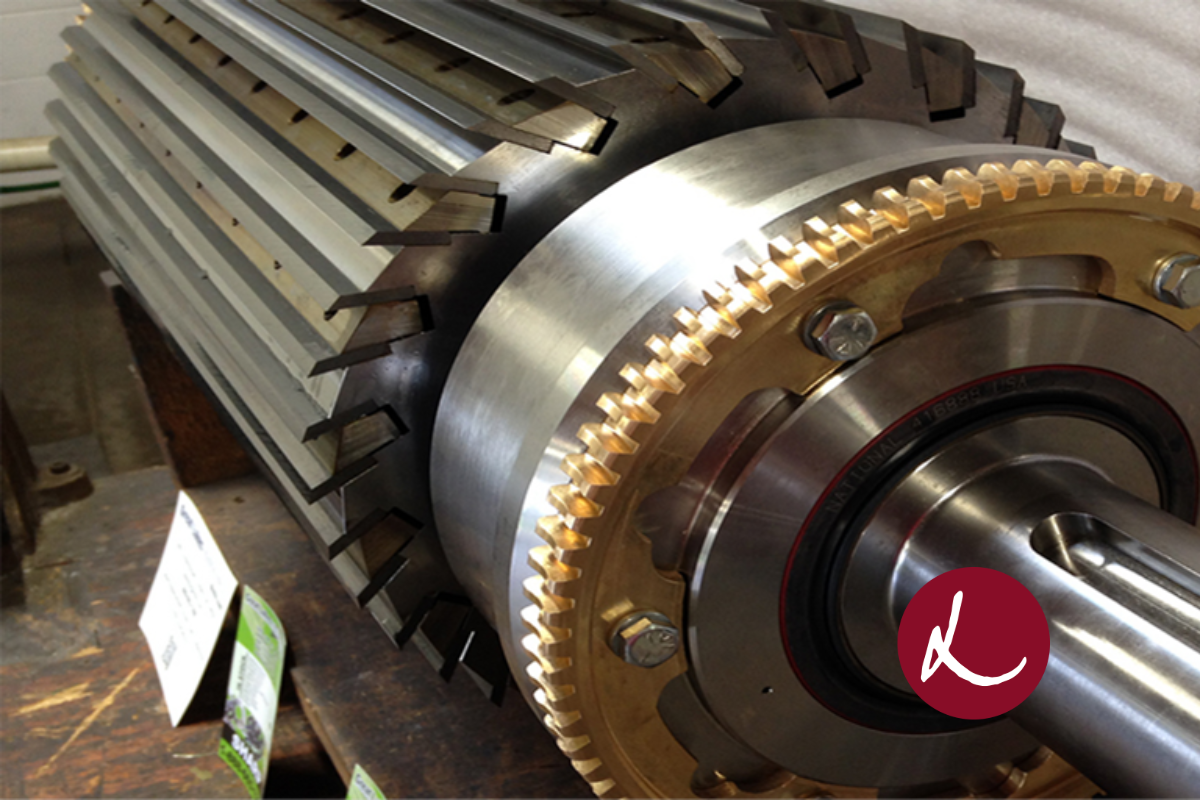

Livingstone Cuts Deal for Leading Blade Specialist

Advises American Cutting Edge on its Sale to Pfingsten Partners

April 18, 2025

|

United States

|

Acquisition

Livingstone’s Industrial team has advised American Cutting Edge and Great Lakes Industrial Knife, Co. (collectively, “ACE” or the “Company”) on its partnership with Pfingsten Partners, L.L.C. (“Pfingsten”). Livingstone acted as exclusive financial advisor to ACE. Transaction terms were not disclosed.

Headquartered in Miamisburg, OH, ACE is a leading distributor of industrial knives, blades, razors, and value-added services supporting a diverse range of end markets globally. ACE’s comprehensive product portfolio, technical know-how, and value-added services establish the Company as a trusted partner in the machine knife and industrial razor industry.

“Livingstone delivered outstanding transaction expertise and strategically executed a customized process for ACE, guiding us through every step and connecting us with a variety of highly qualified partners. We’re proud to have found the right partner in Pfingsten to build on the Company’s long-standing history and uphold the Biehn family legacy,” said Chuck Biehn, Founder of ACE.

Pfingsten is an operationally focused private equity firm founded in 1989. From its headquarters in Chicago, the firm builds better businesses through operational improvements, professional management practices, global capabilities, and profitable business growth. Since completing its first investment in 1991, Pfingsten has raised six investment funds with total commitments of approximately $1.8 billion and has acquired 172 manufacturing, distribution, and business services companies.

ACE will continue to be run by Gregory Billhardt, the Company’s president and CEO. Regarding the transaction, Gregory said, “The management team is enthusiastic about Pfingsten’s investment in the Company, and we remain committed to delivering the same high level of service, deep industry expertise, and attention our customers have come to expect.”

“Founded over 60 years ago, ACE has established itself as the market-leading distributor of industrial blades, serving a broad range of industries with precision and reliability,” commented Andrew Isgrig, Partner at Livingstone. “The transaction highlights the appeal of market-leading businesses with strong fundamentals. ACE’s deep-rooted supplier and customer relationships, recurring revenue model, and the consumable nature of its product line created a compelling investment thesis. These factors drove significant interest from a wide range of buyers seeking a scalable platform with stable demand and long-term growth potential,” he added.

“ACE has built an impressive legacy in the industrial blade industry, and its new partnership with Pfingsten marks an exciting new chapter of expanded opportunity. We’re proud to have helped the ACE team find a like-minded partner committed to supporting their long-term vision and growth,” stated David Modiano, Director at Livingstone.

Livingstone continues to demonstrate excellent momentum advising clients in the industrial distribution sector. Other notable transactions include advising Ives Equipment Corporation in its sale to MCE (portfolio company of Frontenac), AC Controls sale to Kele, Inc. (portfolio company of The Stephens Group), Arcline’s acquisition of Miljoco, and the sale of Engineered Specialty Products, Inc. (portfolio company of Tonka Bay Equity Partners) to Flow Control Group (portfolio company of KKR). Our relationships with leading strategic and private equity acquirers, data-driven approach, and deal creativity are key differentiators enabling our industrial distribution team to deliver excellent outcomes for our clients.

Auman Mahan Furry acted as legal advisor and Plante & Moran, PLLC provided transaction-related accounting services to ACE in connection with this transaction. Paul Hastings LLP acted as legal counsel for Pfingsten.

Share on:

Sectors

Services

Transaction Team